The heart of our strategy

“Trend research is the investor’s core target. In a market

In a globalized world, it’s increasingly difficult to find one’s way around, and that’s where the right tools and expertise can make all the difference.

Vous êtes ici : Accueil > Pourquoi et comment > Coeur de stratégie

Researching bullish and bearish trends

THE RIGHT TOOLS TO STAY IN THE RACE

Are markets really efficient?

Academic research has developed the theory of efficient financial markets in the 1960s. According to the theory, economic actors adopt rational behaviour in order to to maximize their interest.

This theory is widely used today, particularly in asset pricing. But how can we explain financial bubbles and stock market crashes?

The influence of human behavior

Another theory, based on behavioral finance, concludes that markets They reflect the thoughts, emotions and actions of the individuals who are the actors.

Collective behavior in the chain of investors from buyers to sellers (comprehension of information, risk-taking, self-control, cognitive errors, influence of mass psychology) would enable us to establish reproducible patterns.

Trends are a reflection of changing behaviour

Behavioral flaws, such as a series of collective under-reactions and over-reactions explain the phenomenon of bullish or bearish stock market trends.

A bull market reflects the optimism, well-founded or otherwise, of traders. A bear market is the result of pessimism, whether well-founded or not, on the part of investors. operators.

These trends can have a knock-on effect and exacerbate price levels. extreme, triggering financial bubbles or crashes.

A universal phenomenon that we have learned to anticipate

Trends are as universal as human behavior. This is why we have chosen to base our strategy on them.

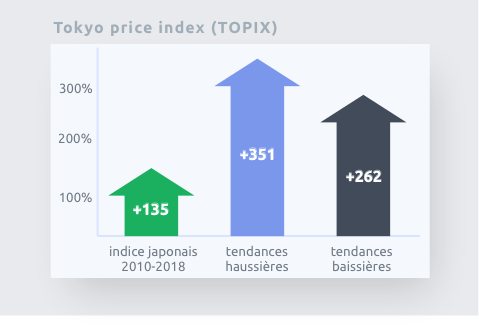

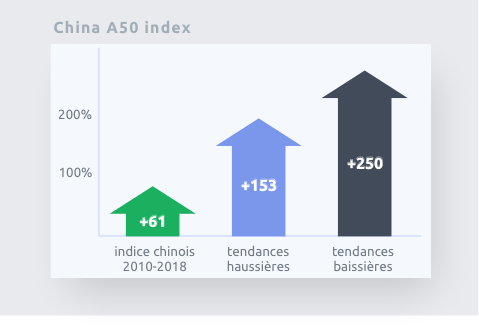

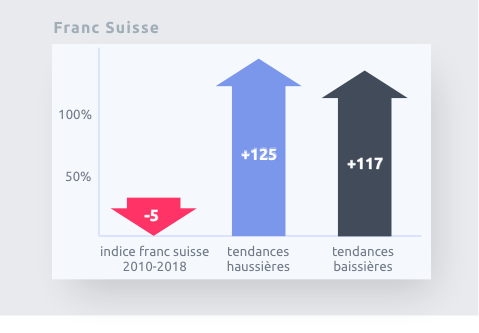

We are trend specialists and have devoted years of research and development to our products. development to study them. Here are three examples to illustrate their potential put into perspective a market’s overall performance over a given period, and trends or bearish trends behind this performance. Let’s take the case of the Franc Switzerland, losing slightly over the 2010-2018 period (-5%). We could deduce that this investment is unattractive, while powerful uptrends (+125% in the (+117% in total) and bearish (+117% in total) trends developed over this period. for our strategy of making profitable investments.

Overall figures can be misleading. That’s why we place so much emphasis on importance to the systematic search for trends.