What others do

“An outdated and limited strategy that no longer corresponds to market expectations.”

Vous êtes ici : Accueil > What others are doing

Passive management

A CLASSIC APPROACH THAT DEMONSTRATES ITS LIMITATIONS

Passive Management

What a performance

Business conditions

Passive Management

What a performance

Business conditions

What is passive management?

A strategy based on ancient theories

The passive investment strategy was born of academic research initiated in the years 60. It began to be used in the 70s, and has since become the strategy of choice. dominant.

A "buy and hold" bias

Passive management does not try to beat the markets by selecting stocks or funds that markets, it does not change its market exposure in line with these trends. last. This is buy-and-hold management.

Once invested, the passive manager waits for the markets to generate the expected returns and remains invested, even in times of crisis.

Contrasting performances

The success of passive management is fuelled by the fact that, over the very long term, markets are destined to grow. If they have an infinite investment horizon, passive investors win.

Nevertheless, the real investor faces very concrete deadlines that correspond to life projects (housing, retirement, studies, assets). If confronted with events (financial bubbles, economic crises, state bankruptcies, geopolitical crises…), weather events), it will not be able to achieve its objectives.

The true performance of passive management

A passive portfolio is directly exposed to declines

The manager of a portfolio invested in passive management has no leverage to avoid, or even mitigate, the consequences of a bear market. Your portfolio can only lose of its value.

How a financial crisis affects your portfolio

The attached diagram shows the actual performance of private investors’ portfolios at the time of the subprime crisis (2008-2009). A portfolio invested in 2005 saw all its gains wiped out at the height of the crisis. A investor whose investment horizon corresponds to this period finds himself irretrievably trapped. He had to give up his project temporarily.

A perverse effect: panic

As your portfolio inexorably declines in value during these crisis periods, you may be tempted to panic and liquidate your portfolio.

This is the perverse effect of passive management. The manager’s immobility leads you to react and make an unfortunate decision (sell at the lowest price).

When markets go bad

Financial crises are part of the investor's world

Financial crises return cyclically. The consequences are devastating for portfolios. Investors must take this into account when defining their investment project. Let’s look at a few examples.

2001-2002 Bubble burst Internet - September 11 attacks

After a period of euphoria on the financial markets, marked by frenzied investment in stocks overvalued technology, the Internet bubble broke out in March 2000. The “new economy” will then collapse. The following year, the effects combined with the decline in stock markets and the economic slowdown caused by the of the Internet bubble will be amplified by the September 11 attacks. At their lowest in October 2002, markets will have lost 50 to 80% of their value.

2007-2009 Subprime crisis

Over the 2000s, a steady rise prices on the US real estate market, combined with historically low interest rates, is encouraging economic players to facilitate access to of low-income households by granting massive sub-prime mortgages (subprimes). Gradual increase in rates decided by the Fed, as well as a non prices will dislocate the real estate market. subprime business model and provoke cascading bankruptcy of lending institutions, including among major US banks. The crisis will then turn into a recession worldwide. In January 2009, the European stock market loses more than 30% of its value in a few months value.

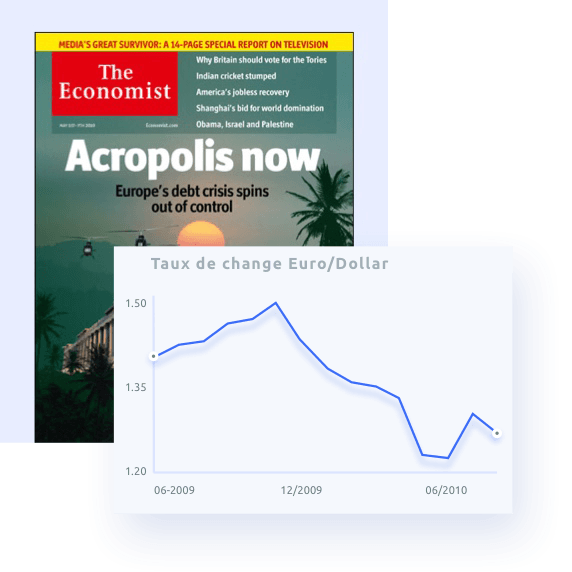

2010 Greek debt crisis

From 2008 onwards, the surge in debt as a result of the effects of the subprime crisis and structural imbalance of the Greek state’s finances, raises the threat bankruptcy of a state within the euro zone. Visit foreseeable consequences of a state defect combined with similar difficulties in other European states (Ireland, Portugal), raise fears a contagion that could threaten the survival of the the euro. The reluctance of EU member states to to help Greece are fuelling a violent reaction. downward speculation. In December 2009, the euro plunged 20% in 6 months, causing panic stock market.