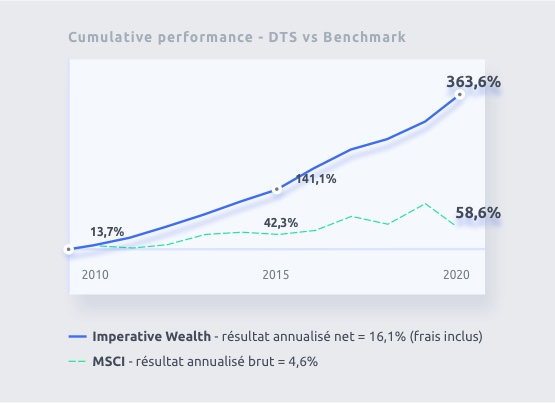

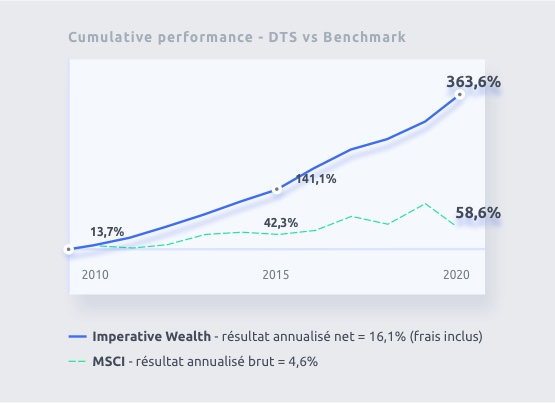

Steady, positive performance

“The quest for performance is too often the victim of emotional choices linked to a particular situation. unstable market. We propose an approach that avoids mistakes of this kind.

Benefit from a positive return, steady and not very volatile, but higher than that of the benchmark closer

To assess our performance, we compare ourselves with best global benchmark, as measured by the Morgan Stanley World Index (MSCI). Over a long period we over- systematically perform this index, and in a manner significant.

How do we achieve these results?

Conventional robo-advisors are generally content to follow passively a selection of indices, which are themselves influenced by markets. As a result, their performance falls when markets fall.

Our investment algorithm makes profits in in both bullish and bearish environments. In this way, we generate absolute performance, irrespective of the general direction of the markets.